Тhe WSDT I was swamped with traders from all around the world coming together to compete for amazing prizes. Amongst this large pool of traders were a good number of begginers who wanted to have a taste of this renowned competition.

This is, therefore, the right juncture to put together 7 steps for beginners who would want to participate in the next WSDT.

Step 1: Device a plan

A plan would always put you one step ahead of others in WSDT. A good plan for WSDT would entail your trading time, volume and the overall outline on how you would like to win the WSDT.

You must also factor in your profit size and the type of market movements you would like to follow.

Step 2: Develop a strategy

The greeks were able to enter the well-fortified city of Troy and win the battle because they had a good strategy. In trading, a larger percentage of your success would depend on your strategy.

A strategy is crucial in WSDT and for that matter, you would have to find, adapt and advance in strategy that works best for you.

There is a good list of strategies that were used in WSDT I which demonstrated efficacy and good results. They are:

- Pivot point

- Break-in/break-out

- Reversal

- Momentum

- Gap and go

- Morning gap

Join WSDT – Spring games – 2021

In addition to the strategies above, most mentors in WSDT utilized or applied one of the following techniques:

- Utilize charts and patterns – Volume, price pattern, candlesticks patterns

- Follow trends/market movements

- Trade on news

- Technical and fundamental analysis

- Taking advantage of weak/low stock (contrary trading).

Step 3: Manage your emotions

Managing your emotions is a big part of this competition. In a highly competitive contest like WSDT, anxiety and other emotional factors throw many people off the cliff.

You must be able to control and maintain your emotional state during even when your trades are going against you. This would keep your focus and enable you to restrategize and come back stronger. Read more on our article The right emotional and mental psychology for WSDT.

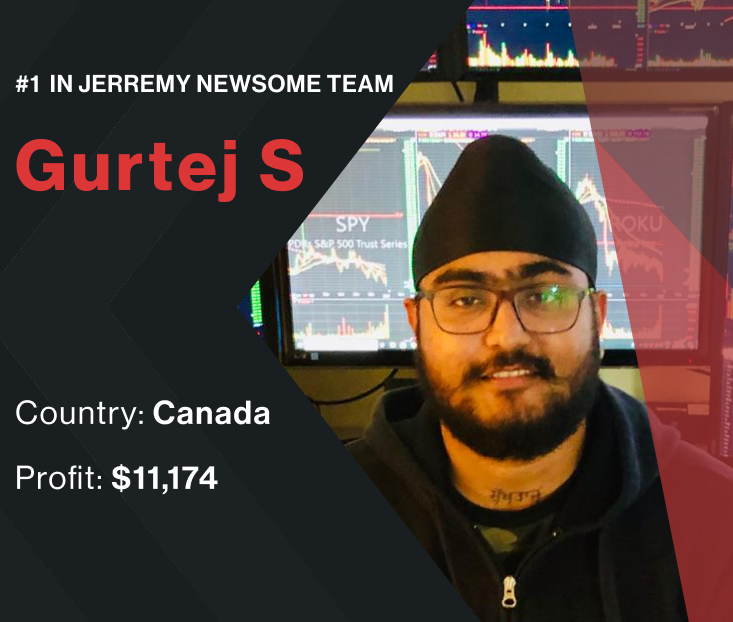

Step 4: Join a team

As a beginner, it is very important to join a team. Every team has a mentor who is well versed in trading, not only that, but you would be able to find experienced traders in the team as well.

This would help you draw from their experience and get a good understanding of trading and the competition as a whole.

Advantages of joining a team:

- You get watchlists, indicators and trading signals from your mentor

- You get the chance to ask questions and receive help pertaining to all difficulties concerning your trading

- You have access to educational videos, live trading sessions, and other essential resources

- You are able to learn from other experienced traders

- Communication with mentors and other team members on the team’s communication channels such as Discord etc. gives you more insights and important alerts to stay ahead.

Step 5: Calculate your risks

Risk is one of the core factors you cannot overlook. WSDT favors day traders who are able to well manage risks. There are two main suggested ways to manage risks:

Cut losses with limit orders

The limit orders are created to curb or limit losses in day trading. Many competitors blew up their accounts because they were not able to manage their losses.

As you already know, the WSDT account has a loss limit, it would be prudent to overtrade and blow your account.

How to use the limit loss to cut losses

- For short positions, place the stop loss or limit order above the recent high

- For long positions place the limit orders below the recent low

- It can be placed a few intervals from an average price movement, based on how volatile the stock is.

Step 6: Maintain small trade sizes

The most common advice mentors give to beginners is to go in with small trade sizes. If you go in for large trade sizes it means, a little spread on the stock will affect your trading drastically. It is advisable to go in small, this will enable you to manage and focus on your trades.

Step 7: Make time to practice

\”I don't fear the man who has practiced 10,000 kicks. I fear the man who practiced one kick 10,000 times.\”

Bruce Lee

Practicing is very important in day trading, and as far as this competition is concerned. You would need to set some time apart to practice, learn from your mistakes and adapt to your strategies. Consistency is what would set you apart from other traders in this competition.